Trading with AlphaVL:

The Newsletter for Growth and Momentum Investing

AlphaVL Trading: The Key to Profiting

from S&P 500 Industrials.

“In trading /

investing it's not about how much you make, but how much you don't lose.” Bernard Baruch

The market direction for equities

advanced Friday, with market participants taking note of a softer tone from

members of the Federal Reserve's committee. This has raised expectations for a

0.25-point rate hike at their next meeting and another 0.25-point hike in

March.

According to the CME Group's Fed Watch,

there is a 55% probability that US interest rates will pause in May, suggesting

market participants are optimistic about economic growth momentum over this

period. With upcoming big cap tech earnings reports being released next week,

investors will be keeping an eagle eye on market fluctuations, looking to

capitalize on any potential soft-landing scenarios resulting from the data.

Friday’s close showed that growth - momentum

had again changed direction as equity indexes rose. The bullish market breadth

on both the NYSE and NASDAQ was encouraging, advancing issues beat declining

issues at a ratio of almost 4:1 on the NYSE and 2.6:1 on the NASDAQ, with

volume at 83% and 86%, respectively. This increase in positive activity pushed

stocks up along with oil prices rising 1.07 to $81.40 per barrel, accompanied

by gains in Gold for a change; this precious metal gained 5.50 and closed at

$1929.40 an ounce. The VIX retreated 3.27% down to 19.85, closing strong,

despite a turbulent few days in the markets prior to Friday's gains. All of the

movements demonstrate that growth after weeks of a negative outlook may be

poised to make a quick turnaround.

Despite the holiday-shortened trading

week with volatile market conditions, our bullish signal on January 12th remains

intact. Evidence of this strong signal lies in both the wider market, where a

positive direction is suggested by improving breadth, as well as in our smaller

trading watch list that is detailed in the spreadsheet attached. Analysis over

the weeks ending January 20th clearly indicate that profitability is achievable

even in unpredictable markets.

As the quarterly earnings season

progresses, investors have held on to positive reactions despite the potential

for weaker growth in leading stocks. Goldman Sachs saw a decline following

their Q4 earnings miss, but Morgan Stanley stood in stark contrast when their

earnings miss was met with larger optimism as the Nasdaq Composite reclaimed all

YTD losses by Friday's close. The Dow Jones Industrial Average and S&P 500

saw an upwards movement as well and managed to overcome a sizable portion of

their weekly losses. This positive directional change had traders optimistic

and bullish over positive growth potentials by market close on Friday.

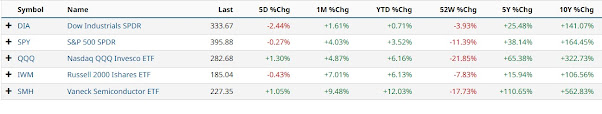

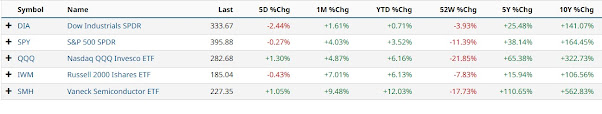

While there is no denying the fact

that the market had a poor week ending the 20th, we must not lose

focus on the Year to date (YTD) results through January 20th. The Dow Jones

Industrial Average is up 0.71%, the S&P 500 is up 3.52%, the NASDAQ 100 is up

6.16% and the Russell 2000 is up 6.13% and the SMH is up 12.03%. Lest you are not familiar with the SMH, it is

an ETF, the Vanek Vectors

Semiconductor ETF, which seeks to

replicate as closely as possible, before fees and expenses, the price and yield

performance of the MVIS US Listed Semiconductor 25 Index (MVSMHTR).

I entered this past week, you may recall that I had set up ten Bull Call Spreads for

possible trades on Tuesday, believing that the upward trend would remain intact. Tuesday’s action was such that I changed course

for the week while only placing three trades, in LW, SPY, and ASML. The week

ended up with two losing and one winning trade, however it was a profitable

week with a 23.1% return on the premium spent. The SPY trade carried the week.

I entered this past week, you may recall that I had set up ten Bull Call Spreads for

possible trades on Tuesday, believing that the upward trend would remain intact. Tuesday’s action was such that I changed course

for the week while only placing three trades, in LW, SPY, and ASML. The week

ended up with two losing and one winning trade, however it was a profitable

week with a 23.1% return on the premium spent. The SPY trade carried the week. The

fourth quarter earnings season for the S&P 500 is off to a less than

impressive start. Companies are reporting surprises mostly to the downside with

the number and magnitude of positive surprises well below their 5-year and

10-year averages. Looking back, this marks the first year-over-year decline in

earnings since Q3 2020. To date, the situation continues its downward trajectory

as companies report negative surprises and analysts revise estimates further

downwards. Thus, the overall trend in earnings decline for this quarter looks

set to continue, while feeding the market volatility.

As such,

I will set up possible trades in the DIA, IWM, QQQ and SPY on both sides of the

screen Bull Calls and Bear Puts while waiting for the market to do what it will

do best, day by day. These trades may

end up as Day Trades or Swing Trades, but I will not be holding anything for a

long period over the next three or four weeks.

To access the

current copy of the data behind our trading please follow this link: Trading

with AlphaVL

Good luck and Good Investing!

I entered this past week, you may recall that I had set up ten Bull Call Spreads for

possible trades on Tuesday, believing that the upward trend would remain intact. Tuesday’s action was such that I changed course

for the week while only placing three trades, in LW, SPY, and ASML. The week

ended up with two losing and one winning trade, however it was a profitable

week with a 23.1% return on the premium spent. The SPY trade carried the week.

I entered this past week, you may recall that I had set up ten Bull Call Spreads for

possible trades on Tuesday, believing that the upward trend would remain intact. Tuesday’s action was such that I changed course

for the week while only placing three trades, in LW, SPY, and ASML. The week

ended up with two losing and one winning trade, however it was a profitable

week with a 23.1% return on the premium spent. The SPY trade carried the week.