Ideas to make the coming week both Profitable and

Enjoyable…

Can the S&P 500 Futures help you

stay in tune with the market trend?

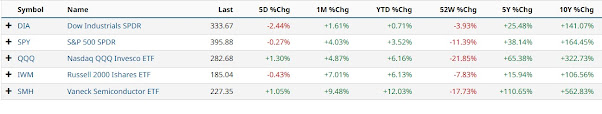

The equity markets closed Friday mixed,

finishing a losing week that saw the rally to start 2023 stall because of

worries about inflation and the Fed’s efforts to slow it down. The Dow and

S&P 500 were in the green Friday, while the Nasdaq declined. For the week,

the Nasdaq sank 2.4%, the S&P 500 dropped 1.1%, and the Dow lost about

0.2%. The big winners in Friday’s session were fossil fuel providers. They held

most of the top spots among the best-performing S&P 500 stocks as oil

prices jumped 2% following Russia’s announcement it would reduce output.

U.S. consumers are more upbeat about

the economy this month despite believing that inflation will rise more than

previously thought, according to a survey by the University of Michigan. The

school’s preliminary February Index of Consumer Sentiment (MCSI) was up 2.3%

from the previous month to 66.4, the highest it’s been since January 2022. The

measure of current economic conditions was 72.6, a gain of 6.1% also the best

level in 14 months.

Inflation reports will be in the

spotlight in the coming week, with the January Consumer Price Index (CPI) out

on Tuesday, and Producer Price Index (PPI) due on Thursday. Also on Tuesday,

the U.S. Senate Committee on Banking, Housing, and Urban Affairs will hold a

hearing on cryptocurrencies and digital assets, amid calls to regulate the

industry and safeguard crypto investors. On Wednesday, last month’s retail

sales figures could offer insights into consumer confidence and willingness to

spend. More updates on the housing market with January building permits and

housing starts are due Tuesday.

The market breadth was mostly negative

for the past week with advancing issues beating declining issues by 153 units

on the NYSE, but declining issues beating advancing issues 1.3:1 on the NASDAQ.

Declining volume was 50% on the NYSE and 60% on the NASDAQ. The VIX eased 0.18

(-0.87%) and closed at 20.53. Crude oil prices jumped 1.74 (+2.23%) and the

March contract closed at $79.80 a barrel. Gold prices fell 3.00 (-0.16%) and

finished at $1875.90 an ounce.

Analysts expect earnings

to continue to decline for the first half of 2023, but are holding to a

forecast of earnings growth for the second half of 2023. For Q1 2023 and Q2

2023, analysts are projecting earnings declines of -5.1% and -3.3%,

respectively. For Q3 2023 and Q4 2023, analysts are projecting earnings growth

of 3.4% and 10.1%, respectively. For all of CY 2023, analysts predict earnings

growth of 2.5%.

In our February 5th

edition, we spoke of the need to be cautious in the up-and-coming week. Following our own advice, we did not add to

the ten positions which we had put on the previous Friday. The positions held

up through the week as you can see below. Nine of the ten positions remain in

Buy status with one Hold. The dollar

value has diminished as you would expect, and we will be looking to close six

positions should the market continue downward in the coming week. Those under

consideration for closing are ABNB, AMD, COF, CRM, EXPE and NUE. All good companies but with currently weakening

trends.

All that we do stems from

the S&P 500 constituents, broken down into seven major indices along with

twelve sector groupings. This is also

where signs of weakening can be seen with two of the members now rated ‘Hold,’

four ‘Sell’ and eleven ‘Buy.’ Nothing to panic over at this time, but we will

be watching this grouping closely as the new week opens up.

A tip for the inquisitive,

keep your eye on the trend in the /ES futures contract around 10:00 AM each

morning, 71.3% of the time the market will close in the direction of this

contract each day. Based upon the

strength of the trend over time, you will be able to determine if hanging

around the market will be worth your time or not for the day.

To access the current copy of the data behind our trading please

follow this link: Trading with AlphaVL

Good luck and Good Investing!

Vince